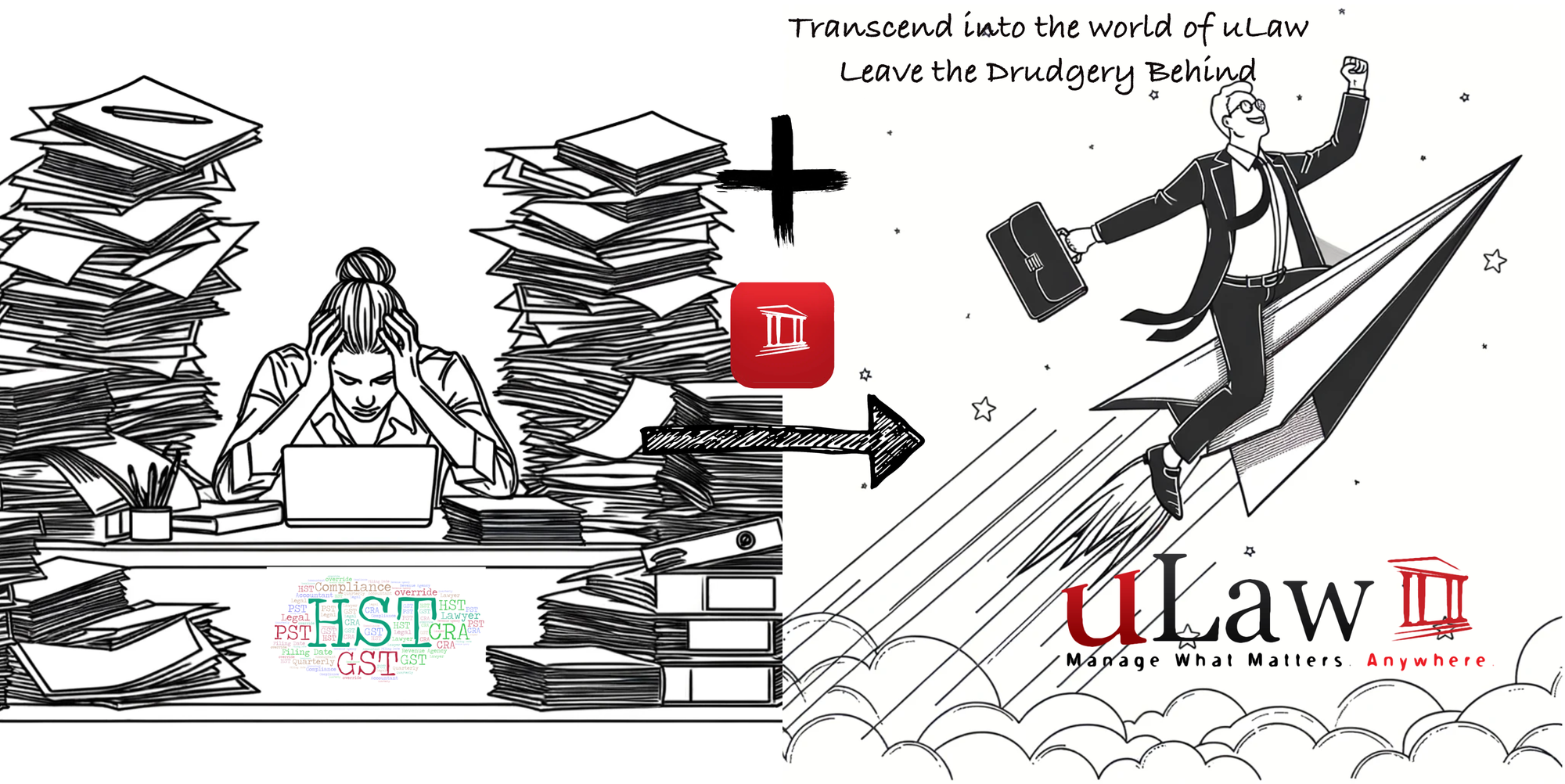

Breathe Easy: Streamlining HST Submissions for Lawyers with uLaw

For Canadian lawyers, grappling with the complexities of the Harmonized Sales Tax (HST) can be a time-consuming and stressful burden. Between managing legal cases, client relationships, and the intricacies of the law itself, navigating the complexities of Harmonized Sales Tax (HST) submissions to the Canada Revenue Agency (CRA) can be a daunting task for legal practitioners. The intricate details involved in accurately calculating HST collected, managing Input Tax Credits (ITCs), and adhering to compliance requirements are substantial. This is where uLawPractice emerges as a game-changer, particularly designed for legal professionals seeking efficiency and precision in their financial management.

Understanding HST Obligations in Legal Practice

HST returns are pivotal in the financial landscape of any legal practice in Canada, requiring meticulous attention to the details of taxable services provided. Legal practitioners are tasked with not only determining the HST collected on legal work but also on additional income streams such as notary services or other corporate revenues. Additionally, the process involves identifying eligible ITCs and making necessary adjustments for the period in question, which can be overwhelming without the right tools at disposal.

The Challenge of Conventional Practice Management Systems

Traditional practice management systems, while beneficial for case management and client interactions, often fall short in addressing the nuanced requirements of legal accounting, particularly when it comes to HST submission. These systems may not offer the detailed financial reporting needed to comply with CRA's stringent regulations, leaving practitioners at risk of inaccuracies in their tax filings.

The Challenge for Lawyers: Juggling Legal Work and HST

While the concept of HST returns may seem straightforward, the reality is far more complex. Completing accurate and compliant HST returns requires meticulous recordkeeping and calculations. Lawyers, faced with the demands of their legal practice, often encounter several challenges:

- Separating HST-Chargeable Services: Legal services themselves are typically exempt from HST in Canada. However, other services offered by lawyers, such as notary services or disbursements covering court filing fees, might be subject to the tax. Identifying and segregating HST-chargeable services requires diligence and a clear understanding of the tax framework.

- Calculating HST Collected and Paid: Accurately calculating the HST collected from clients and the HST paid on business expenses is crucial. This involves meticulous recordkeeping of invoices, receipts, and other relevant documents.

- Understanding Input Tax Credits (ITCs): ITCs allow businesses to recover a portion of the HST paid on eligible business inputs. Understanding which business expenses qualify for ITCs and calculating the amount recoverable adds another layer of complexity.

- Keeping Up with HST Changes: The CRA periodically updates its regulations and interpretations concerning HST application in different scenarios. Staying current with these updates requires ongoing research and education.

How uLaw Steps In: Simplifying HST Submissions

uLaw acts as a powerful ally for lawyers navigating the complexities of HST submissions. Here's how:

- Streamlined HST Tracking: uLaw integrates seamlessly with your legal accounting system, allowing you to effortlessly track income and expenses categorized as HST-applicable. This eliminates the need for manual data entry and ensures consistency across your financial records.

- Automatic HST Calculations: uLaw can automatically calculate the HST collected on legal fees and other applicable services. It can also calculate the HST paid on eligible business expenses, simplifying the process of claiming ITCs.

- Comprehensive Tax Reports: uLaw generates detailed tax reports that summarize all HST-related activity within a specific period. These reports meticulously categorize HST collected, paid, and recoverable as ITCs. This comprehensive data serves as a valuable resource when preparing your HST return and ensures all relevant information is readily available.

- Reduced Risk of Errors: Manual calculations and data entry are prone to errors. uLaw's automation features significantly reduce the risk of human error, ensuring the accuracy and completeness of your HST return.

- Improved Compliance: With uLaw's comprehensive reporting and automatic calculations, the chances of overlooking a crucial detail or missing an ITC are minimized. This promotes greater compliance with CRA regulations, reducing the risk of penalties or audits.

The Power of Integration: A Complete Legal and Financial Solution

The true strength of uLaw lies in its integrated nature. Unlike standalone practice management software, uLaw seamlessly integrates legal and financial aspects of your practice. This eliminates the need for manual data transfer between separate systems, ensuring data consistency and reducing the risk of errors.

Beyond HST Submissions: Additional Benefits of uLaw

The benefits of uLaw extend far beyond simplifying HST submissions. Here are some additional advantages:

- Improved Efficiency: Streamlined workflows and automated processes free up valuable time lawyers can dedicate to client service and casework.

- Enhanced Client Communication: Streamlined communication tools foster better client relationships and improve overall client satisfaction.

- Reduced Administrative Burden: Automation and data integration minimize administrative tasks, allowing lawyers to focus on core legal work.

- Better Financial Management: Comprehensive financial reporting provides valuable insights into practice performance and allows for informed financial decisions.

The uLaw Advantage: A Case Study Lawyer in Windsor Ontario.

Consider the experience of this solo practitioner from Windsor, Ontario whose name we shall not name because of confidentiality, transitioned from a conventional practice management system to uLaw for managing HST submissions. Previously overwhelmed by the manual calculations and unsure about the accuracy of ITC claims, the practitioner found relief in uLaw's automated system. The comprehensive tax reports provided by uLaw offered clear insights into HST obligations and entitlements, enabling the practitioner to submit HST returns confidently and accurately. This transition not only ensured compliance with CRA but also reclaimed valuable time for legal work and client engagement.

In the ever-evolving landscape of legal practice, staying ahead in financial management is crucial. uLawPractice offers an innovative solution that bridges the gap between practice management and legal accounting, empowering legal practitioners with the tools needed for efficient and accurate HST submissions to the CRA. By choosing uLaw, legal practitioners can navigate their HST obligations with confidence, ensuring compliance while maximizing their time and resources for what truly matters – delivering exceptional legal services.

#uLawPractice #LegalAccounting #HSTSubmission #CRACompliance #LegalTech