uLaw is Streamlining Legal Accounting: Empowering Legal Practitioners to Communicate in Their Native Legal Lingo, Not in Accounting Jargon

In a profession where time is a precious commodity, legal practitioners often grapple with the complexities of legal accounting. The Law Society of Ontario (LSO) outlines various accounting systems, each with its advantages and drawbacks. Yet, the introduction of uLaw's legal accounting software marks a significant shift. It's a solution that speaks the language of lawyers, not accountants, seamlessly integrating legal tasks with automated accounting processes. uLaw transcends traditional barriers, making legal accounting accessible even to those with minimal accounting background.

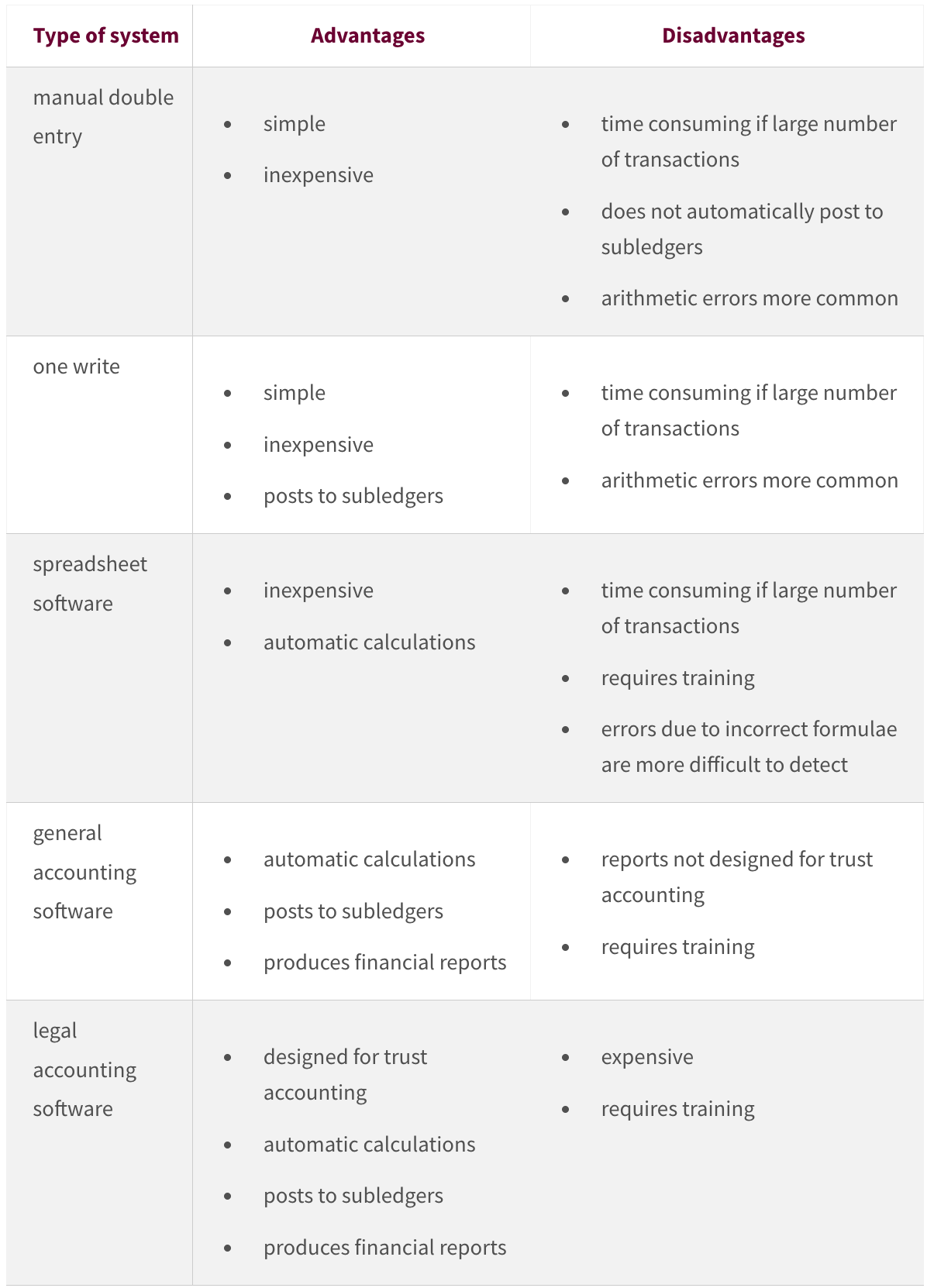

Understanding Traditional Accounting Systems

The LSO highlights several accounting systems, from manual double entry to spreadsheet software and general accounting programs. Each system caters to different needs but often requires a substantial understanding of accounting principles. The LSO publication can be read by clicking here

The Challenges of Conventional Accounting in Legal Practice

Conventional accounting systems present various challenges for legal practitioners. From time-intensive manual entries to the risk of errors and the need for specialized training, these systems can be a hindrance rather than a help.

Conventional accounting in a legal setting, while fundamental, often presents challenges that can significantly affect daily operations. Here are some real-world examples to illustrate this:

Manual Double-Entry Systems: A small law firm using a manual double-entry system for their financial records. The firm's staff spends considerable hours recording every financial transaction twice – once as a debit in one ledger and again as a credit in another. This includes tracking billable hours, expenses, retainer fees, and payments.

Impact:The time-consuming nature of this process diverts staff from other critical tasks, such as client case work or business development. Additionally, the risk of human error in manual entries can lead to discrepancies, requiring further time to reconcile.

Spreadsheet-Based Accounting: A solo practitioner uses Excel for managing their practice’s finances. They manually input data into spreadsheets, creating formulas to calculate billable hours, expenses, and revenues. As their client base grows, so does the complexity of the spreadsheets.

Impact: The lawyer spends significant time updating and maintaining these spreadsheets. Complex formulas can lead to errors that are hard to trace, potentially affecting financial accuracy. This extra administrative burden can detract from time better spent on legal work.

General Accounting Software (aka QuickBooks, Xero etc.) in a Trust-Heavy Practice: A medium-sized firm specializing in real estate law uses a general accounting software not tailored for legal practice. The software lacks specific functionalities for managing client trust accounts, an integral part of real estate law. The firm has to use additional methods or workarounds to manage these accounts.

Impact: Inefficiencies arise from using a system that doesn’t cater to the specific needs of the legal practice. There's an increased risk of non-compliance with legal accounting standards, leading to potential legal liabilities. This is wha most competition who only focus on practice management as a CRM and not combined with legal accounting do where they export all complexity to General Accounting software

Introducing uLaw: Legal Accounting Made Simple

uLaw emerges as a game-changer in this landscape. It's tailored specifically for legal professionals, automating the intricate processes of ledgering, journaling, and managing trust accounts. This section will introduce uLaw’s unique features, emphasizing how it simplifies legal accounting by operating in the background while lawyers focus on their cases.

uLaw’s Subliminal Accounting: A Paradigm Shift

uLaw’s approach to accounting is revolutionary. It transforms every legal action – be it recording a retainer or logging a disbursement – into an automated accounting transaction. This "subliminal accounting" ensures compliance and accuracy without the lawyer needing to speak the language of accountants. This part will explore the intricacies of this process and how it benefits legal practitioners, especially those with little to no accounting experience.

The realm of legal accounting is traditionally laden with complex procedures and terminology that can be daunting for legal practitioners. However, uLaw’s innovative approach, termed "Subliminal Accounting," is revolutionizing this field. This section explores how uLaw’s software simplifies accounting processes, providing detailed examples of its impact on everyday legal practice.

Automating the Essentials (Few examples of Subliminal Accounting):

- Retainer Management: When a lawyer records a retainer in uLaw, the system automatically handles the necessary ledgering. For example, if a lawyer receives a $5,000 retainer, uLaw not only records this amount in the client’s trust ledger but also updates the trust bank balance and the client trust listing, ensuring compliance with trust accounting rules. This automatic reconciliation saves the lawyer from manual calculations and cross-referencing.

- Disbursement Tracking: Consider a scenario where a lawyer incurs a court filing fee of $200 on behalf of a client. Upon logging this disbursement in uLaw, the software automatically records it as an expense, updates the accounts payable, and reflects it in the client's invoice. This seamless integration ensures that all financial aspects are accurately tracked without requiring the lawyer to perform additional accounting tasks.

- Invoicing and Revenue Recognition: When an invoice is raised in uLaw, it translates into accounts receivable in the firm’s books. For instance, if a lawyer bills for services worth $3,000, uLaw automatically updates the revenue ledger, accounts receivable, and prepares the invoice for client delivery. This automation streamlines the revenue recognition process, ensuring that the firm’s financial statements are always up-to-date.

uLaw stands out by speaking the language of lawyers, not accountants. This distinct approach is embodied in its intuitive design and functionality, which align closely with the everyday workflow of legal professionals.

For instance, when a lawyer enters a retainer, they don't need to navigate through intricate accounting ledgers or journals. Instead, they simply record the retainer in a manner that's coherent and familiar – as a straightforward transaction within the client's matter. uLaw then takes over, automatically processing this entry through the necessary accounting channels.

Similarly, when managing disbursements, lawyers enter expenses directly related to a case, like court fees or research costs, without getting bogged down by accounting complexities.

uLaw automatically categorizes these expenses appropriately in the background, ensuring they are correctly reflected in financial reports and client invoices. This seamless integration allows lawyers to stay focused on the legal aspects of their work, confident that the accounting side is accurately and efficiently handled.

Moreover, uLaw simplifies billing and invoice generation. Lawyers can generate invoices using common legal terminologies, and the system translates these into comprehensive financial records.

This means that lawyers can continue to operate within their familiar legal framework, while uLaw silently performs the complex accounting tasks in the background.

This lawyer-centric approach extends to trust accounting as well – a critical aspect of legal financial management.

Lawyers can manage trust transactions within the context of their client matters, and uLaw ensures these transactions comply with regulatory standards. This includes automatically handling trust-to-general transfers, recording trust receipts, and maintaining comprehensive trust ledgers, all without requiring the lawyer to delve into the intricacies of trust accounting principles.

In essence, uLaw empowers legal practitioners by translating their actions into the language of accounting, without them having to speak it. This not only enhances the efficiency and accuracy of legal practices but also significantly reduces the time and effort spent on financial administration. By speaking lawyer lingo, uLaw ensures that legal professionals can focus on what they do best – practicing law, while it takes care of the rest.

In conclusion, uLaw represents a new era in legal accounting - one where legal professionals can stay compliant and manage their finances without being bogged down by complex accounting jargon or procedures. It's a tool that speaks 'lawyer', making it an indispensable asset for legal practices of all sizes, especially for those who wish to focus on their legal expertise while leaving the accounting to the software.