Chart of Accounts refresher: get compliant!

Chart of Accounts

A Chart of Accounts can be thought of as the brain of your business, from an accounting perspective. If something is wrong with your chart of accounts, that’s when you know you have a problem with the way your firm’s finances are being handled.

So, let’s start with what a Chart of Accounts is..

As money is spent or received by a company during the course of its activities, several accounts are often utilized simultaneously depending on what exact procedure is taking place.

From large to small, business entities often rely on different accounts to ensure money is flowing in the right direction. Hoteliers, bar owners, banks and plumbers can reasonably be expected to have vastly different types of accounts due to the variation in their business models. The same can be said for lawyers also.

Nevertheless, from the perspective of an accountant, there are a lot of similarities among businesses in terms of the types, or categories, of accounts being used. This is why several different subdivided categories are routinely used in the production of a Chart of Accounts (COA).

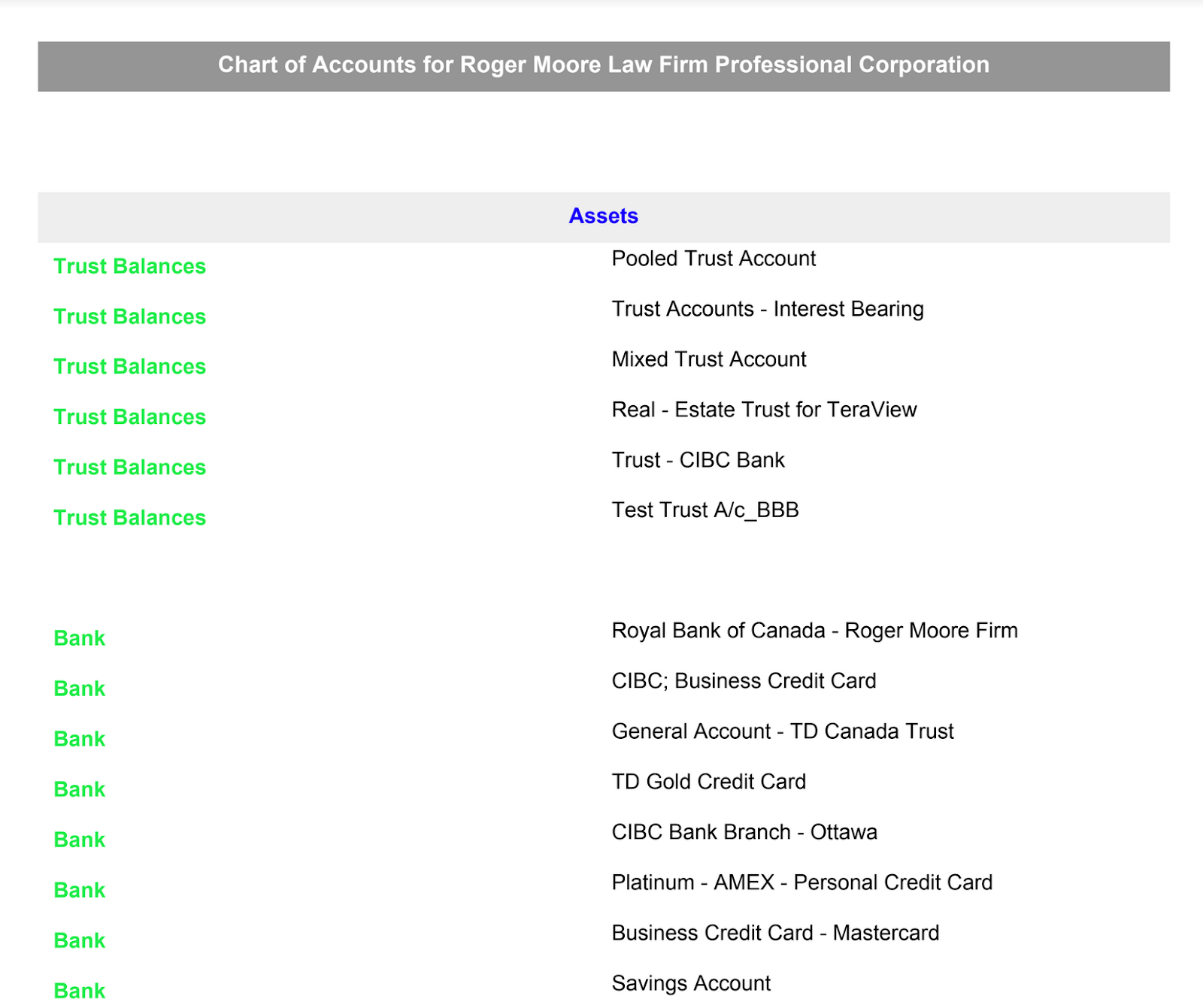

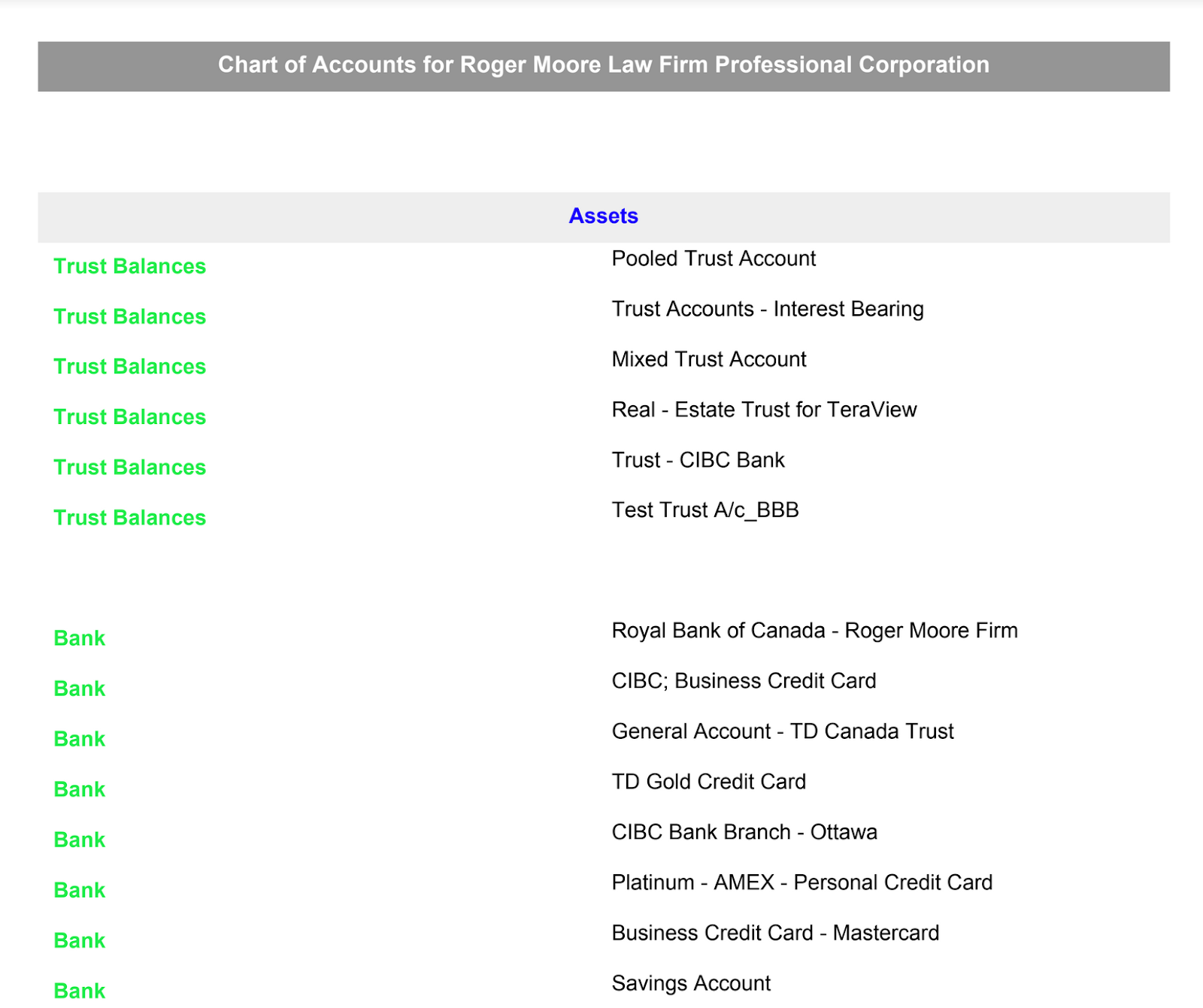

A Chart of Accounts is a list used to define each class of items or accounts where money is spent or received in an organization or business entity. The following five categories are routinely used in a chart of accounts for many businesses:

- Assets

- Liabilities

- Capital

- Revenue

- Expenditures

The purpose of a Chart of Accounts is that it segregates the above components of a business so that it’s easier to scrutinize its finances. A chart of accounts acts as an organizational tool. It’s the accounting equivalent of a table of contents, and it serves as a useful tool to scrutinize a firm’s financial health. At uLaw, we like to think of a Chart of Accounts as the accounting ‘brain’ of the business.

Accounts within a COA are defined by an identifier or number with a caption or header attached to it. Most COA lists use numerical identifiers to subdivide the different types of accounts.

Chart of Accounts for Canadian Legal Practitioners

While there are many similarities across different legal entities (businesses, non-profits, organizations and government agencies), Canadian legal practitioners do have a few marked differences when it comes to how their chart of accounts looks in comparison to others.

Many lawyers collect retainers and thus are holding money in trust. While this arrangement is considered an asset to the bank once the money flows into the firm, it’s also a liability for the lawyer because it’s not their property. If not handled properly, it is impossible to discern whether you are compliant with Law Society regulations. As well, incorrect reporting of earnings also throws off your earnings reporting to the Canada Revenue Agency. Trust accounting is a very special account that needs to be managed well.

If done improperly, you can trigger an auditing process not only from the Law Society, but also the CRA. This is because if you’re incapable of ensuring that your compliance documentation with the Law Society is in order, it’s highly likely your CRA reporting of earnings has been thrown off.

Proper accounting for revenue is complicated for legal practitioners in comparison to other businesses. Depending on their area of practice, a lawyer’s books can vary wildly. Also, unlike many other businesses, expenses actually generate revenue for a law firm.

As a whole, revenue often comes in the form of legal fees and disbursements, and other income such as notary fees. If the recording of these isn’t done well, the P&L (profit and loss) statements created by the corporation can become misleading or entirely incorrect, and thus the HST owings to the CRA can be imprecise and submitted wrongly to Canada’s tax agency, the CRA.

The uLaw Example

For more than ten years, the uLaw team has worked with lawyers who are not handling their accounting properly. Before coming to uLaw, they were using a mismatch of different softwares to handle their bookkeeping. The problem with this approach is that it separates accounting from practice management, which is itself incorrect, as compliance begins and ends with proper accounting to begin with.

Once accounting is subtracted from practice management, it ends up getting outsourced to another type of generalized accounting software, which is not specifically geared for lawyers. It must be adapted in a hybrid, which means the categorization of transactions can become mixed up and spell out real trouble for a firm when it’s time to file paperwork to the CRA. Imprecise accounting can take years to discover. Hence, we have the Chart of Accounts to scrutinize finances.

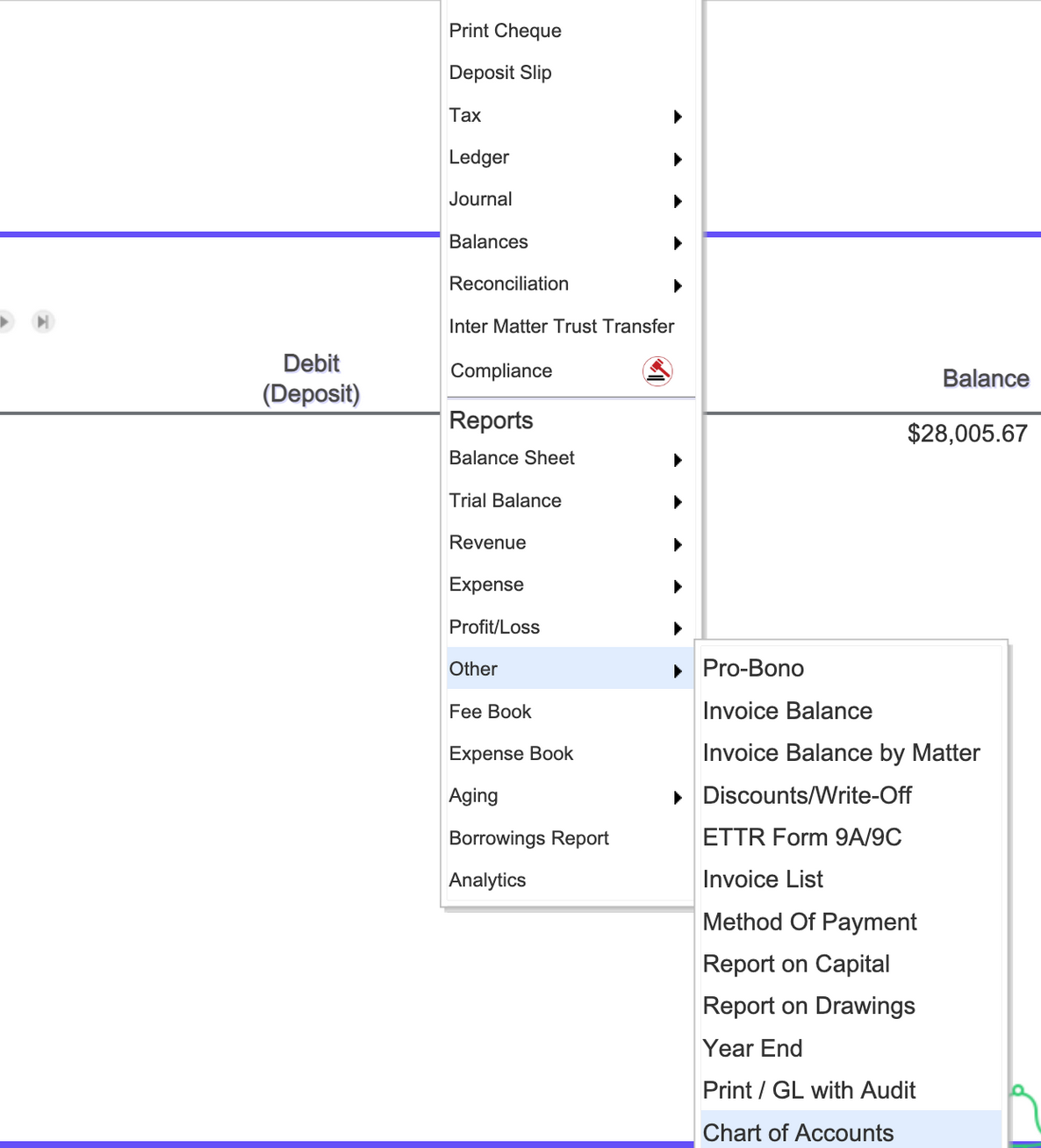

Here is an example of how to generate a chart of accounts automatically with uLaw