How software is making legal accounting in Manitoba way easier

When it comes to legal bookkeeping in the province of Manitoba, there's a lot to take into consideration for a law firm to be operating properly in the eyes of regulators.

Trust accounting isn't a walk in the park, and regular reconciliation statements need to be created and frequently sent to the Manitoba Law Society in order to remain compliant.

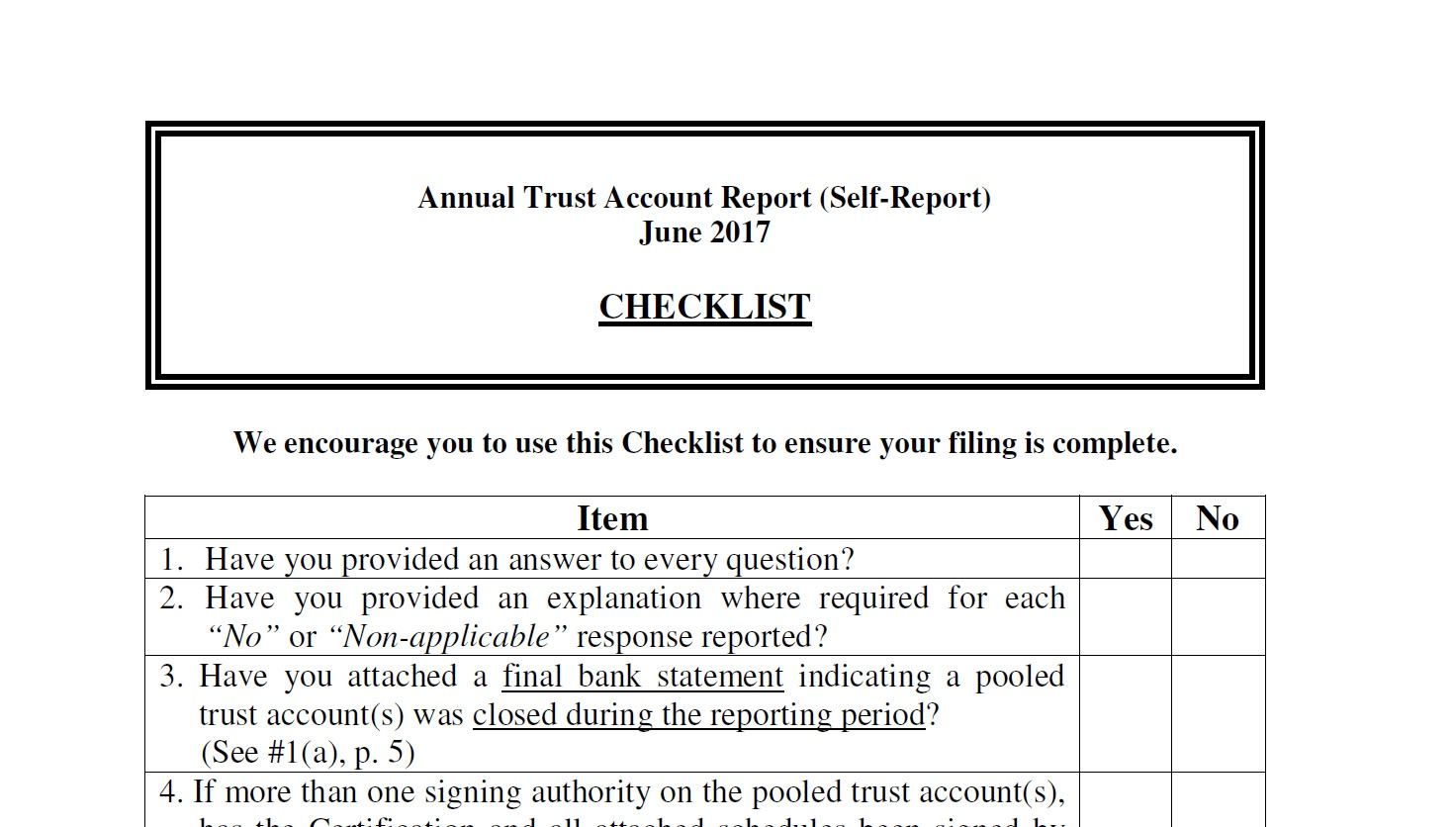

Anyone who has managed a trust account in Manitoba is likely aware of the Law Society's annual Self-Report, which is required to be filled and sent to regulators once per year along with meticulous documentation of trust accounting, general accounting and procedural accounting data, which must be up-to-date and accurate.

uLawPractice is 100 per cent compatible with everything required to be filled out on this form, down to the very last dot. Since the software is connected with your bank accounts, it keeps a steady eye on bank statements and thus a lot of arithmetic is conducted automatically. Once an auditor from the Law Society of Manitoba starts knocking on your door, you'll easily be able to produce anything they ask for.

Unlike the Law Society of Upper Canada, Manitoba regulators have a special document that must be reviewed by an accountant if a lawyer in the province has been shown to not be financially compliant with trust accounting. Called a "Form-D", practitioners are expected to append a number of documents and have it stamped by a licensed accountant.

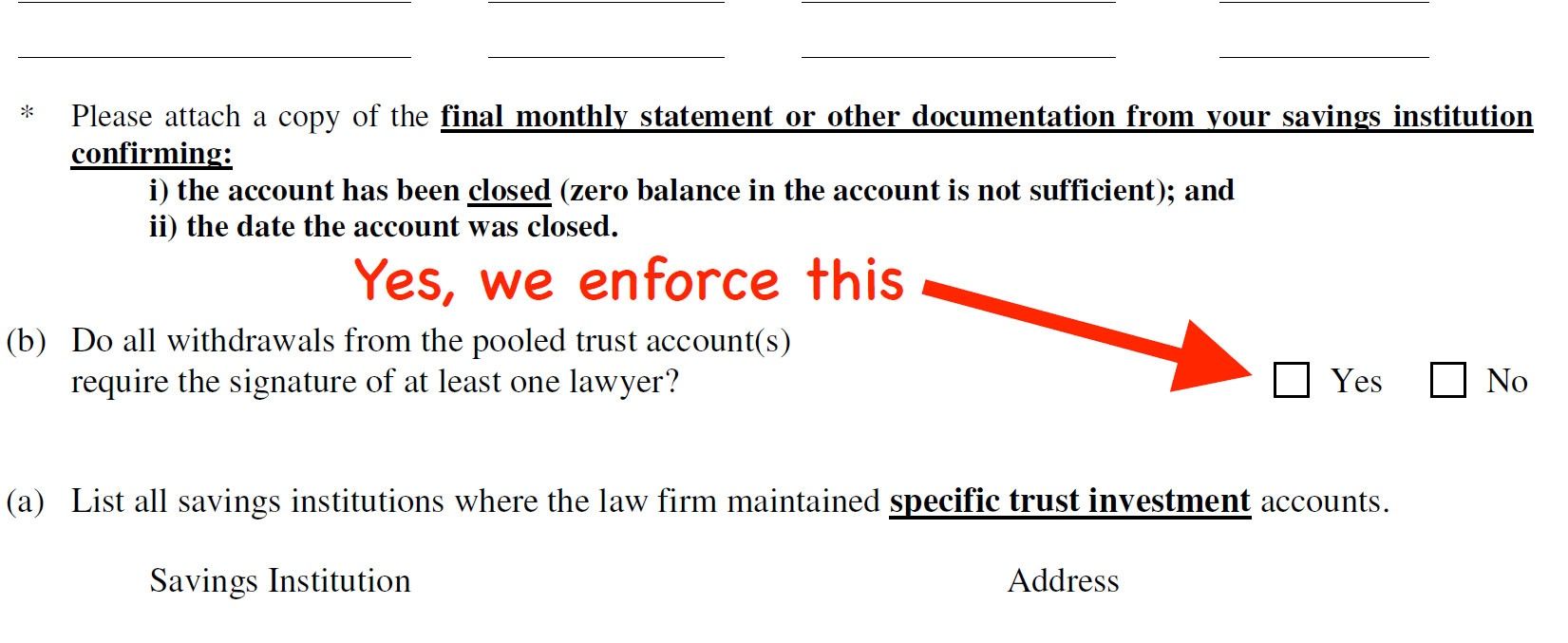

Even digital signing is enforced and required inside of our cloud-based legal accounting and practice management software, which we offer for free for your first 30 days.

Take a look at the full, annotated list of forms, procedures and accounting this software can conduct automatically by a bookkeeper or practitioner who is utilizing uLawPractice!