PREPARING FOR AUDITS WHILE INCREASING BILLABLE HOURS

It might be tempting to fall prey to the prevailing myth that it’s profitable to cut corners occasionally when it comes to legal bookkeeping.

After all, the Law Society calls it a Bookkeeping Guide, right? So maybe it’s true the numbers don’t have to add up--at least not right away. Perhaps with enough time, you’d be able to pull through a potential audit if given enough time to dredge up the right documentation. Setting aside the cornucopia of negative consequences, disbarment et al, the reality of the situation is that you’re actually losing out on money by cutting corners. (emphasis added) With a slight change in your business model, you can increase your billable hours.

Supposing you were a negligent carpenter cutting down on nails and screws in order to save a few bucks on each job, you might be able to argue the case that it’s actually profitable to cut corners--you know, provided that nobody notices. But you’re not a carpenter, and lawyers these days can easily follow the rules and actually make more money by calibrating bookkeeping software to track interactions with clients.

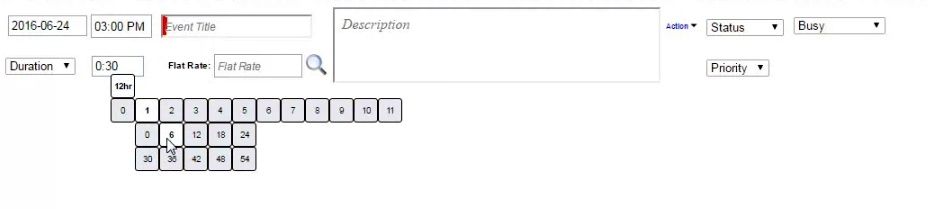

The process is pretty basic. When a client calls and you’re near your computer (and who isn’t these days?) you can navigate to a segment of a webpage that looks like this:

With the use of a docket, like the one above, you should be organizing interactions with clients by paying attention to the following four criteria. It isn’t uncommon for this practice to lead to increased profits when it’s time to bill your clients. It also saves a lot of time and leaves no room for error.

- The start of your conversation/consultation

- The end

- Details

- And a title of the work

By going through the up-front effort of recording this data, facilitated through software, you should be keeping precise tabs on just how much work you’ve been doing for your clients, and for how much you should charge them for a particular matter.

Supposing you receive a phone call from a client on a DUI matter and you determine the entire conversation to be pro-bono work, abiding by these parameters and recording the data is helpful to see if your freebies are even a worthwhile venture.

And if it isn’t pro-bono, a quick tabulation by the software itself will tell you how much you intend to receive for the work you’ve been doing.

It’s important within the description of each consultation to be detailed and describe the actual interaction. Expressing yourself within the parameters of legal accounting software is highly effective.

Staying safe

In addition to making it easier to observe how much a client owes you, the benefit of using a double-barreled software solution to legal accounting and practice management ensures you’re compliant with Law Society guidelines for bookkeeping.

This means you'll be following the rules while financially benefitting from enhanced organization.

Using this software correctly means you don’t need to have a care in the world if you get audited, because you’re following the rules and making more money.

Why not give it a shot for a month and see how it goes?

Tags: Blogs