Profit & Loss: a financial visibility metric that drives sustainable legal practice

The profitability of a law firm is not just a year-end concern. For sole practitioners, it's a continuous operational signal which can (or at least, should!) be visible throughout the year.

Unlike larger firms with dedicated finance departments, solos must function simultaneously as lawyer, manager, and financial steward. A clear understanding of profit and loss (P&L), supported by modern legal accounting technology such as uLawPractice’s FinSight Dashboard, is therefore essential.

The goal of our article here is to examine profit and loss closer, and look at it through the lens of a Canadian Law Firm. We will also explain how to interpret P&L data in real terms. Lastly, we also aim to explain how technology generates these metrics for you, and how they can be used as actionable business intelligence if analyzed correctly and attentively.

(Note: you can visit the uLaw FinSight dashboard any time when using uLaw. Simply click the link at the top of the page on the toolbar.)

What “Profit and Loss” Actually Means in a Law Firm Context

At its core, a Profit and Loss Statement summarizes basic accounting arithmetic.

Revenue - Expenses = Net Income (or loss)

For a law firm, this is not abstract accounting! This equation reflects billing discipline, the timing of how a law firm is timing its cash flow, and other operational efficiencies (or deficiencies!)

In the Canadian legal context, P&L analysis must be understood alongside financial management and practice management checklists issued by law societies (such as the Law Society of Ontario), trust accounting rules, and tax regulations laid out by the Canada Revenue Agency.

Reading the P&L Through a Monthly Lens

People tend to think that P&L statements make most sense on a yearly basis, or perhaps a quarterly basis. But the truth is these statistics can be analyzed monthly as well.

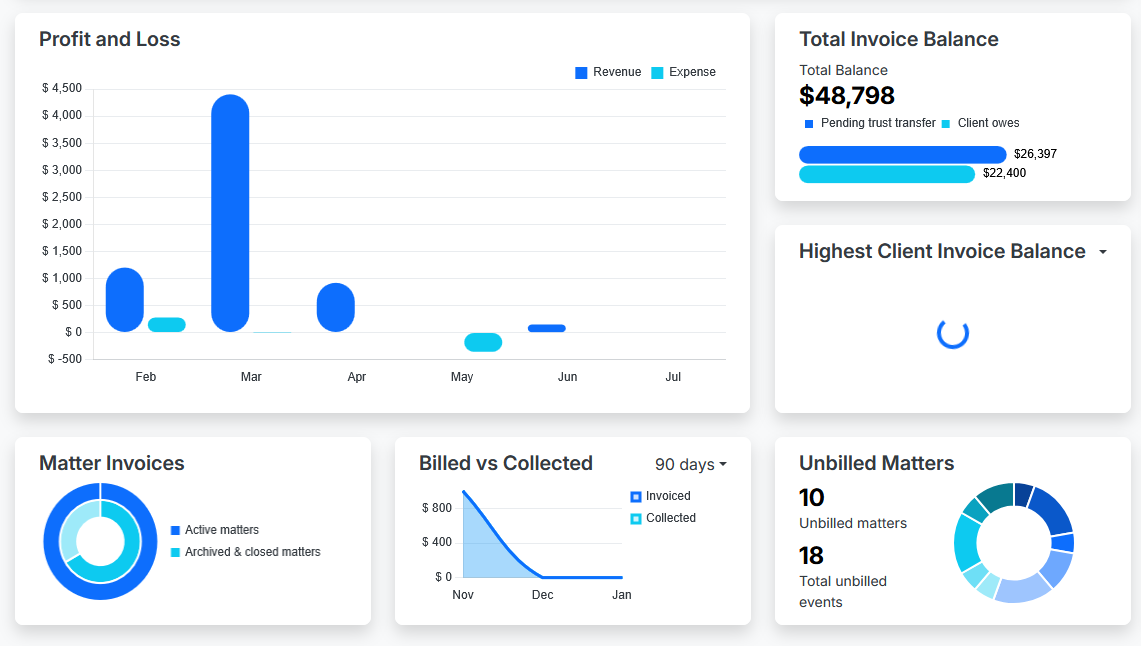

The FinSight Dashboard visualization (as shown in above diagram) illustrates monthly revenue and expense fluctuations from February through July. Several important accounting insights emerge:

1. Revenue Volatility can be Normal! But not always

Large revenue spikes (e.g., March) typically indicate:

- Completion of contingent or milestone-based matters

- Collection of aged receivables

- Seasonal billing patterns (common in litigation and real estate)

Depending on the exact makeup of a law firm and the types of clients it takes on, might create predictable peaks and valleys where this is totally normal (and expected). Whereas, spikes that are not expected may mean something is awry!

Lower or negative net months (e.g., May) do not automatically signal failure, but they demand explanation. There should always be a reason for low or negative net months, and it will always be smart to be aware of why this might be happening.

Key question for solos:

Was the decline driven by reduced billings, delayed collections, or fixed overhead outpacing revenue?

2. Expenses Are Often Fixed, but Revenue Is Not

Unlike revenue, many law firm expenses are semi-fixed or fixed, including:

- Practice management software

- Rent or home office expenses

- Professional insurance

- Regulatory fees

- Continuing professional development (CPD)

This means:

- Profitability is often margin-sensitive

- Even modest expense-creep can materially affect net income. This is most readily apparent during low-revenue months.

3. Net Income ≠ Cash on Hand

A common solo practitioner pitfall is confusing profitability with liquidity.

Accrual-based profit is revenue that is earned. This doesn't mean that it's collected funds. Knowing when expenses can actually be paid is a cornerstone to the financial reality for a lot of law firms.

uLawPractice’s strength lies in surfacing this distinction clearly, because it lets users actually observe what has been billed, what's been collected, and what money (if any) remains outstanding. It is a good practice to be aware of the different classifications of money entering a firm. Of course, software is designed specifically to assist law firm operators to make these distinctions clear, evident, and visual. This is one of the central reasons why the development team at uLawPractice recently revamped its finsight dashboard.

Why Technology Matters: Beyond Traditional Accounting

From Historical Reporting to Operational Insight

Traditional accounting software often answers:

“What happened last month?”

uLawPractice’s FinSight tools aim to answer:

“What does this trend mean for my practice—and what should I do next?”

Key advantages include:

- Real-time revenue vs. expense visualization

- Month-over-month performance comparison

- Early identification of margin compression

- Data-driven forecasting

For solos, this replaces gut instinct with quantified financial awareness.

Profit Margin: The Metric That Matters Most

Profit margin is calculated as:

Net Income ÷ Revenue

A solo practitioner with high gross billings but poor margins may be:

- Overpaying for services

- Underpricing work

- Carrying inefficient file types

FinSight enables lawyers to correlate:

- Revenue peaks

- Expense behaviour

- Net outcomes

This empowers informed decisions such as:

- Adjusting fee structures

- Reducing non-essential overhead

- Prioritizing higher-margin practice areas

Without being able to drill deeper into your profit margins, it may not be easily understood where a firm is making most of its money. Perhaps even more important than this is to know which types of clients, or practice areas, simply aren't worth doing anymore because they don't pay enough for it to be worthwhile!

It's easy to forget about tracking expenses. Being able to visualize the expenses and how they pair with revenue make it easier to determine if your investment is paying off.

Compliance, Governance, and Financial Discipline

Law Societies across Canada, in all of our provinces, place a lot of emphasis on the following:

- Separation of trust and general accounts

- Accurate record-keeping

- Transparent financial reporting

While a P&L statement does not include trust funds, disciplined P&L tracking supports:

- Better audit readiness

- Reduced compliance risk

- Stronger financial governance

Technology-assisted accounting reduces human error and reinforces professional responsibility. Even just glancing at our FinSight dashboard's P&L graph can help you quickly decide what needs further investigation.