uLaw presents legal accounting lectures to 100s of paralegals in 2023

Between February and March 2023, uLawPractice's trained EDU educators visited four classrooms across Ontario to deliver a series of lectures to paralegal students.

Two main lectures, "Everything Practice Management" and "Disbursements Demystified" were delivered to six classes, equating to more than 90 students across a one-month period. These two courses are recognized by Law Societies in more than three provinces as being educational material eligible for Continuous professional development credits. The Law Society of Ontario has even listed these courses as bona fide educational material in its Technology Resource Centre.

"These courses are intended for anyone who wishes to streamline the way their law or paralegal firm handles regulatory business activities," says CEO of uLawPractice Terry Curtis. "Ontario paralegal colleges in particular have a vested interest in ensuring students leave the classroom understanding what kinds of rules they'll be subjected to upon graduation. It's an honour for these colleges to draw upon uLaw's wealth of knowledge in this area."

While the majority of Ontario paralegal colleges make use of uLaw, Durham College in particular goes a step further by making use of uLaw's enhanced academic integrity program, which sees that each student has individualized access to their account. Fanshawe College is also an earlier pioneer in support of this program.

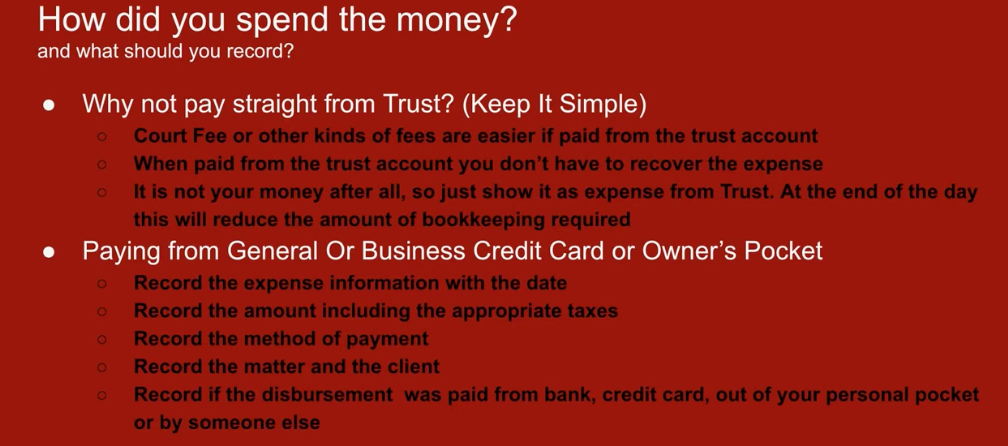

The below screenshot is an example of a slide from one of the presentations: "How did you spend the money".

These types of webinars really drill down on how money is moved around from client, to trust, and ultimately, to the possession of a legal practitioner after the work has been rendered and properly accounted for.

This is intended to support students learning the regulatory rules that legal practitioners must abide by; so they can satisfy the criteria laid out by not only the Canada Revenue Agency, but also the Law Society. Both of these regulatory agencies have very specific criteria needed for licensees to remain in good standing.

Here are some links to the presentations held recently:

https://www.youtube.com/embed/2wvQKUsNKhI?feature=oembed

https://www.youtube.com/watch?v=https://youtu.be/2wvQKUsNKhI

https://www.youtube.com/embed/drLnu4JzwdE?feature=oembed