(Untitled)

Due to the nature of the services lawyers and paralegals provide to the general public, special obligations are placed on legal practitioners in Canada in order to remain in compliance with federal and provincial regulators.

The collection of tax and reporting of income is regulated at a federal level. As with any business in Canada, companies (law firms) and individuals (sole proprietors) are expected to produce accurate and up to date financial information about their enterprise to the Canada Revenue Agency (CRA).

Provincially, law practice providers are also obligated to report additional financial and practice-related information about their firm to Law Societies, which have long been entrusted by legislatures to regulate the legal profession. Since before Canada became a country, representatives of government, to varying degrees, relied on self-regulated groups of legal practitioners to maintain public trust of the legal profession.

In an effort to combat corruption and ensure integrity, each province’s Law Society has a vigorous framework established to ensure legal practitioners are accountable to the people they serve.

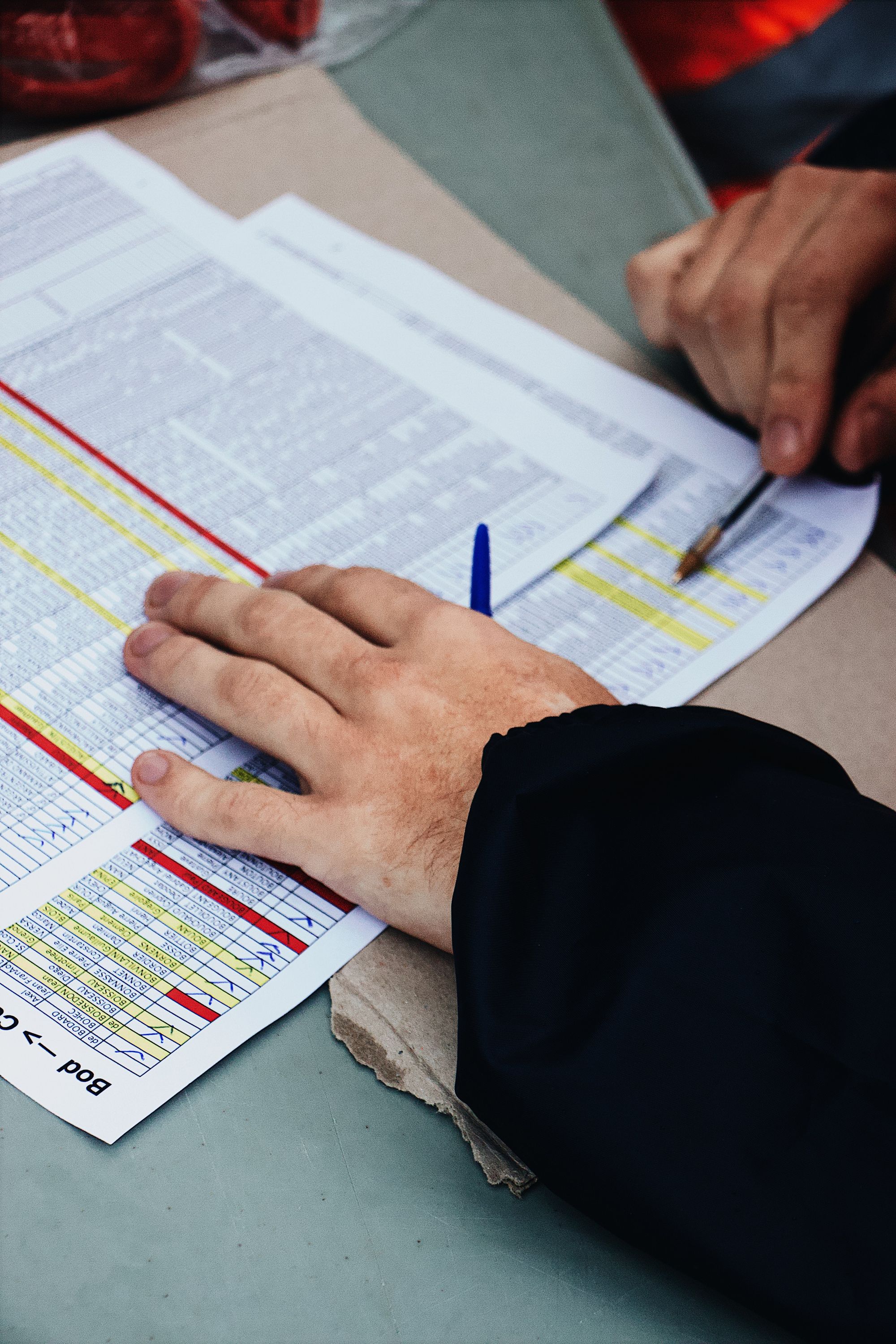

As is often the case for lawyers (and, increasingly, paralegals) acting on behalf of a client, money is held in trust and disbursed during the course of a legal matter. Various internally-produced journals, books and ledgers must be congruent with the flow of funds from one account to the next. The same data generated by these documents must also be corroborated with meticulously collected source documents, which often take the form of bank statements and deposit slips.

One particular advantage to the strict reporting obligations for Canadian legal practitioners is the byproduct that it creates for law firms. Data produced through compliance documents actually serve as useful tools when making decisions about how a firm is running its practice.

Accounting systems explained

Law Societies across Canada have long been educating licensees about the different styles of accounting available, because their auditors are the ones responsible for mulling over all the financial data every time a spot audit is conducted on a firm.

Today there are roughly five different types of legal bookkeeping styles currently used by law firms. Depending on where a firm is placed in its life cycle (i.e. just starting out vs. a more established, multi-partner law firm) can be a factor in determining which method is most suitable.

Manual double entry

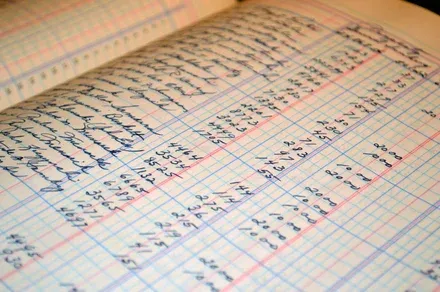

Manual double entry bookkeeping is a tried and true, paper-and-pencil method of accounting that has been used for centuries. According to historical records, the first evidence of manual double entry was found during the Goryeo Dynasty in pre-modern Korea between 918-1392 C.E.

To this day, some lawyers continue to use manual double entry due to its simplicity, but also as a force of habit. Sole practitioners with decades of experience working for themselves may find it difficult to see any reason to change the manner in which they handle their accounting: with the use of a simple, single-margin notebook.

One of the advantages to manual double entry is that, at its core, the system is very straightforward and inexpensive. Each time a transaction occurs, it is recorded and accounted for in at least two places. Using this method provides self-checking accuracy while also creating an adequate audit trail--both of which are important when running a business of any kind.

Double entry bookkeeping works by recording both debits and credits captured during the accounting of a firm’s financial activities.

When a single transaction takes place, a manual double entry system will record the movement of money in two instances: once on the left-hand side of the accounting equation, and another on the right-hand side. In this way, the system acts as a check and balance against the flow of money within an account.

There is one notable downside to this style of accounting. It is the potential for human error to take place and remain undetected, sometimes for years at a time. This is because manual double entry heavily relies on whomever is filling out the information and performing the arithmetic tasks necessary to properly account for transactions taking place within the firm. Another downside to manual double entry accounting for lawyers and paralegals is that this method can also be time consuming, especially if a firm has a large number of transactions to record.

One write

Also known as single-entry accounting, this method captures data using only a single logbook. This method is often perceived as being simpler because it doesn’t require data to be inputted twice, as it is with double-entry.

To properly use this method of bookkeeping, users must be sure to delineate between revenues and expenses. See the table below for examples of both three and five column one-write accounting logbooks.

Sole practitioners who are first starting out may opt to use either manual double entry or one-write accounting styles because the number of transactions taking place may be small enough to handle with the simple logbook approach. As a firm matures, practitioners may increasingly see the advantages of more sophisticated bookkeeping solutions. This is all the more pertinent once a lawyer starts accepting retainers and managing trust accounts.

Once a firm begins to conduct higher volumes of transactions, a one-write system can become cumbersome. This may lead to the need for a firm to migrate to another accounting system. Also, similar to manual double entry, another disadvantage to the one-write system is that undetected arithmetic errors may arise.

Spreadsheet software

Widespread computer usage since the 1990s has solidified spreadsheet software as an industry standard for bookkeeping in virtually all industries. Now more than ever, companies have a wide array of software options available for producing spreadsheets. Some are free and work as a “software-as-a-service’: meaning they no longer require individual files to be stored on a device’s hard-drive.

One large advantage of spreadsheet software is that it can automatically perform arithmetic tasks. Improper or mistaken usage of formulae and data entry into incorrect spreadsheet cells, however, can create problems which may be hard to detect. This leads bookkeepers down the unfortunate route of pouring over months of financial data to find the source of a bookkeeping error. Depending on the situation, some bookkeepers might not even notice these problems until they get audited.

General Accounting Software

Spreadsheet software may be the de-facto manner of handling books and records for most businesses. A whole industry of software providers have risen up to provide general accounting software to further assist the work of bookkeepers across many industries.

General accounting software makes automatic calculations and posts data to sub-ledgers, which is a boon to anyone who is tasked with handling the books and records of a business. Overall, this method far outperforms older styles of bookkeeping. As one may expect, this style of bookkeeping is more expensive but generally worth the money as it saves a lot of time and minimizes arithmetic errors. Many private businesses, large and small, make regular use of general accounting software for their needs.

General accounting software does not discriminate the type of industry that it can be used with. While this makes for a pleasant general-purpose solution for a wide array of industries, this method of bookkeeping has an essential weakness for specialists, such as legal practitioners, since law firms are often handling trust accounts and retainers from clients.

If a law firm is dealing with trust accounting, it might be a good idea to plan a proper bookkeeping and accounting solution developed specifically to produce the types of financial reports which need to be generated to remain in compliance with the law society.

5. Legal Accounting Software

This is the gold standard of legal bookkeeping, and it’s a method that is well known by Law Societies as being superior in its delivery of the basics of accounting as well as some of the more advanced bookkeeping requirements to be a practitioner throughout Canada’s provinces and territories.

Since legal accounting software is specifically geared for the needs of law firms, many forms and reports are easily generated while also utilizing data that has already been inputted into the system. Using this method is the fastest and most efficient way to prepare a firm for optimal financial compliance with regulators, as evidenced by its glowing recommendation in internal law society literature (for LSO bookkeeping guidelines for lawyers and paralegals see ‘types of accounting systems’).

One notable downside to legal accounting software is that it does require some training before its users can make full use of the system. Thankfully uLawPractice, Canada's only legal accounting and practice management software, will guide you step by step on how to prepare for audits before you run into trouble.

Canadian legal practitioners (and their staff) interested in migrating their practice to a secure and cloud based practice management and legal accounting solution may benefit significantly from making use of a 30-day free trial. Just click the link below to begin.