How coders unintentionally found $13,000 of lost income for an Ontario lawyer

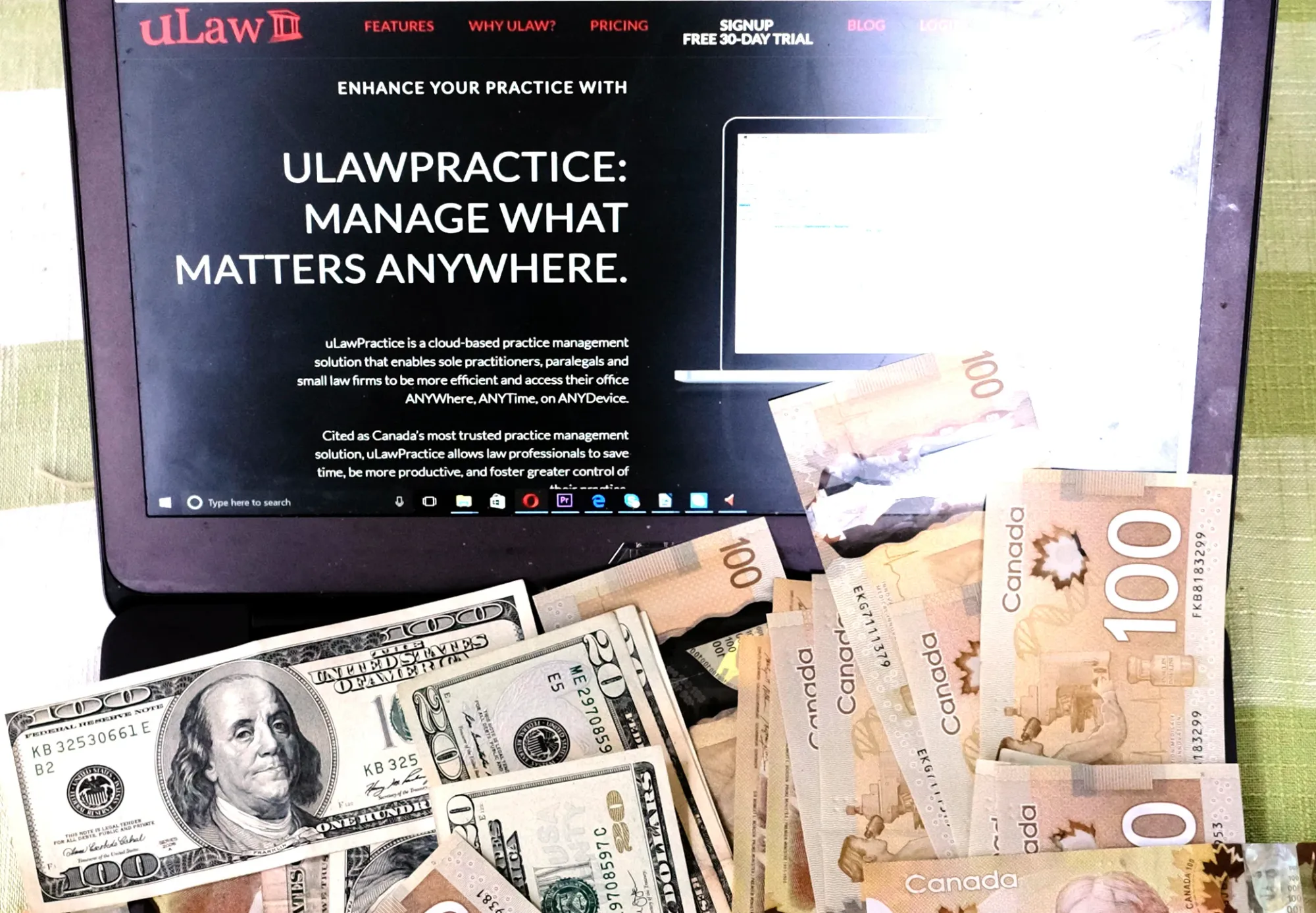

An Ontario lawyer is $13,000 richer because a few lines of code were changed inside his accounting software.

It was an unintended (yet welcomed) consequence of coders implementing a feature inside uLawPractice that was originally geared to benefit Manitoba lawyers, who are required to follow slightly different rules when it comes to the way they manage their accounting in comparison to their counterparts in Ontario.

“This just goes to show that compliance is actually just good business sense rather than a costly impediment, as some lawyers like to believe. Here we have a lawyer in Ontario basically finding more than $10,000 that wouldn't have been detected unless our coders were making our software compliant in a jurisdiction on the other side of the country,” said Terry Curtis, CEO of uLawPractice.

uLawPractice is Canada’s only legal accounting AND practice management software. Basically it’s a cheap and all-inclusive web-based option for lawyers to automate court forms and eliminate costly and redundant administrative activities firms must conduct in order to function as a real business.

The software manages a firm’s finances, almost automatically; so it came as a surprise for this particular lawyer when he noticed a few items glowing red on his monthly reconciliation statement. He phoned uLawPractice's technical support line wondering why, only to quickly find out he'd actually hit the jackpot.

The only thing wrong with his accounting for the month was that he’d forgotten to cash $13,000 worth of cheques to himself for services rendered to clients several months ago. These were the only outstanding cheques, and they were written to himself!

This is because uLaw was recently updated, but it was only intended for users in Manitoba.

Earlier this month, a member of uLawPractice’s compliance coding team (CCT) was working late one night to implement a small feature to help Manitoba lawyers become more compliant with advanced auditing procedures regulated by the Law Society of Manitoba.

Called a Form-D, some Manitoba lawyers are required to provide detailed analysis of outstanding cheques older than 6 months.

While many jurisdictions require monthly reconciliation, many do not go the extra mile to demand lawyers to identify and explain why each outstanding cheque has not been cashed after six months.

Several Manitoba lawyers are required to do this (the parameters are listed on Schedule #4) but in other jurisdictions it’s not a necessity.

Despite this, when one of our coders went inside the software to implement a basic highlighter to be applied to an item after 6 months, a lawyer on the other side of the country came to realize he’d forgotten about a lot of money he had laying around.

The grand sum of these uncashed cheques? $13,000... not insignificant amount of money! But sometimes a lawyer can forget to pay themselves when they're dealing with trust accounting, especially if they have a lot of clients!

Increased compliance with regulators is just good business sense.

Try uLawPractice for free